Your intent data vendor just sent you a “hot” list. A dashboard flashes green. An “account” is “surging.”

You pass this “high-intent” lead to your sales team. A sales rep picks it up, stares at the name of a 10,000-person company, and asks the only questions that matter:

- “Who at this company is interested?”

- “What did they actually do?”

- “Why are they interested now?”

The data has no answer. It’s just a company name and a vague topic.

Welcome to the “black box” of B2B intent data. Sales teams don’t trust the leads because they’re built on a “proprietary model” that provides no tangible proof. This isn’t intelligence; it’s a guess. And it’s the reason 81% of buyers are dissatisfied with their B2B purchasing experience – they are being hounded by reps who have no context.

If your intent data platform is a source of “profound disappointment” and “insufficient proof,” it’s time to stop accepting the black box. It’s time to demand transparency.

Here is a 5-point checklist to ask your current (or future) intent data provider.

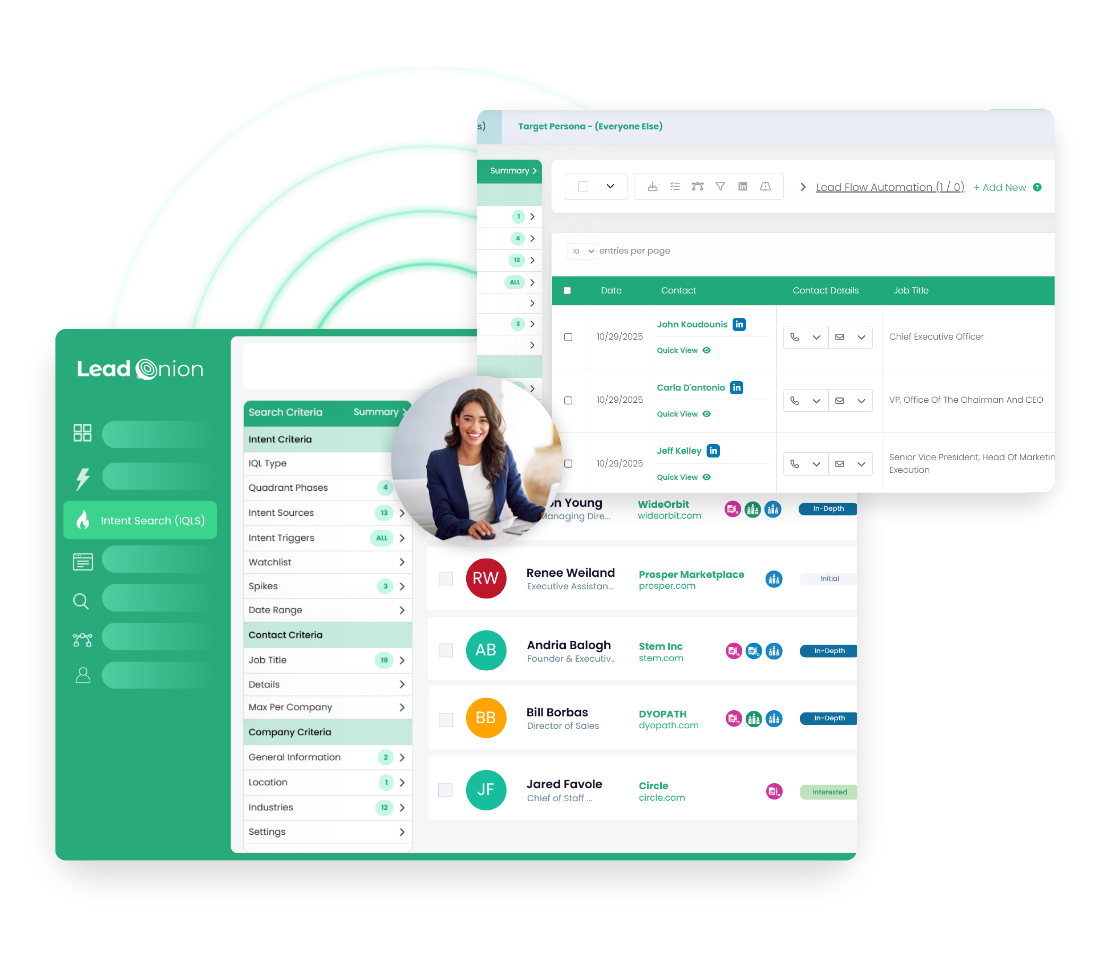

1. “Can you show me the person, or just the account?”

This is the most important question. “Accounts don’t buy… People do.”

The biggest flaw in legacy intent data is that it operates at the account level. It can’t tell you if a “surge” in research is coming from a C-level decision-maker or an intern writing a research paper.

If your sales team has to guess who to talk to, the lead is already cold.

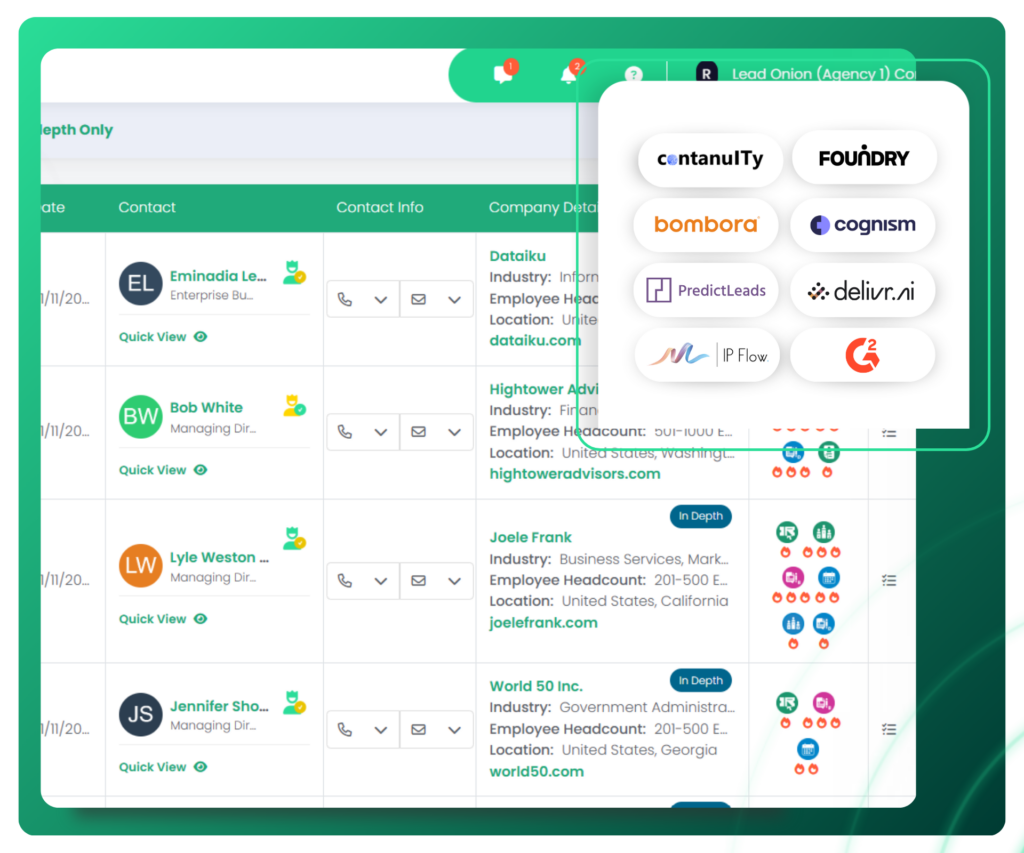

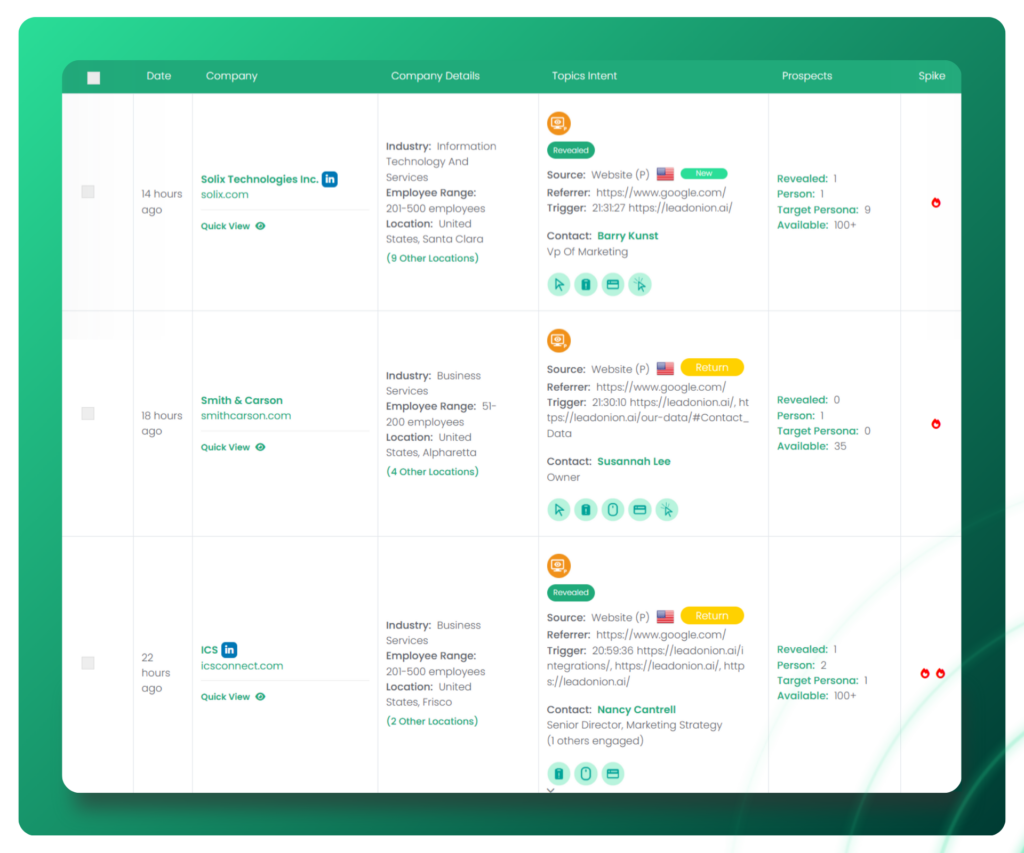

Vague, account-level signals are a waste of sales time. True intent data must be able to pinpoint the specific person at that account who is actively researching a solution.

Demand this: Person-level intent that shows you the job title, seniority, and name of the individual showing interest.

2. “Is this signal from one source, or multiple sources?”

Many “black box” platforms are one-trick ponies. They identify a “spike” from a single data stream (like their own co-op or a single technographic source) and call it “intent.”

A single signal is not intelligence; it’s an anomaly.

True intent is built on corroboration. A real buyer doesn’t just do one thing. They read a 3rd-party review, then they search a competitor’s name, then they visit your website.

A powerful platform must be able to combine multiple signals from many sources (e.g., topic research, competitor research, website visits, AI-driven analysis) into one unified view.

Demand this: A multi-signal approach that corroborates different data points to prove the intent is real.

3. “Can you show me the activity on my own website?”

A huge portion of intent data is “third-party.” It tells you what an account is researching on the rest of the web. This is crucial for finding buyers in the “dark funnel” but is incomplete on its own.

The highest-intent signal a buyer can give is visiting your own digital property – your pricing page, your blog, or your case studies.

The problem? Most of this traffic is anonymous.

Your intent platform must be able to connect the dots. It needs to “de-anonymize” your website traffic (first-party intent) and connect it to that account’s third-party research activity.

Demand this: A platform that combines first-party website intent with third-party topic intent.

4. “Do I get this signal in real-time, or in a weekly report?”

A lead that is five minutes old is 10 times more likely to convert. An intent signal that is a week old isn’t an opportunity; it’s a history lesson.

Yet, many platforms and data providers deliver their “insights” in weekly CSVs or static dashboard updates. By the time your sales team gets the lead, the buyer has already been contacted by a faster competitor.

This isn’t just a data problem; it’s a speed problem. Outdated data is just as bad as inaccurate data.

Demand this: Real-time alerts (like a Slack notification) that tell your sales team the second a high-intent buyer is active.

5. “Can you show me where this buyer is in their journey?”

Not all intent is created equal.

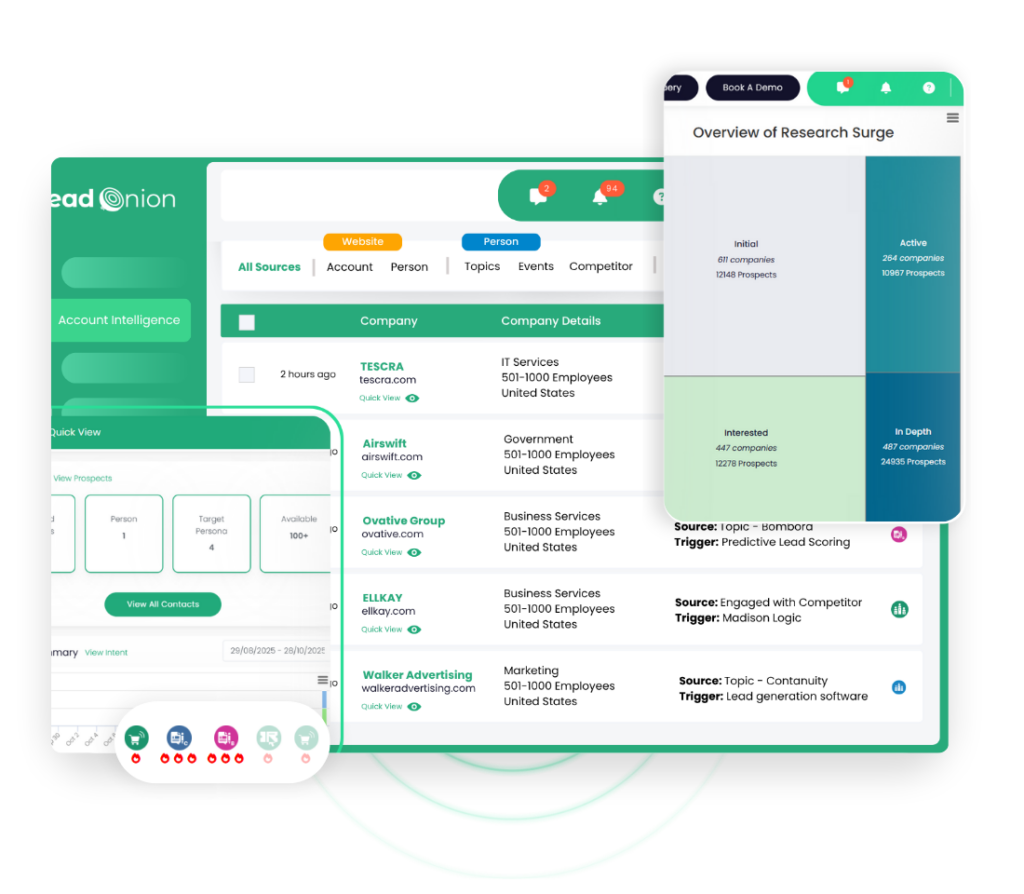

There is a massive difference between a buyer in the “Initial” research phase (e.g., searching “what is account-based marketing?”) and a buyer in the “In-Depth” phase (e.g., searching “Lead Onion pricing” or “6sense alternatives”).

Most platforms just dump all these signals into one “surging” bucket. This forces your sales team to treat a top-of-funnel researcher with a hard-sell demo pitch, which kills the conversation.

A truly transparent platform doesn’t just give you a list; it gives you a map. It should use a predictive model to score those signals and tell you what stage the buyer is in, so you can tailor your message.

Demand this: Predictive buyer-journey scoring that separates “browsers” from “buyers” and tells your team how to engage.

Stop Paying for a “Black Box”

If you’re paying for an intent data platform, you are not paying for “more data.” You are paying for precision and actionability.

If your provider can’t answer “yes” to these five questions, they are not an intelligence partner. They are a “black box.” And they are costing you the trust of your sales team and your customers.

It’s time to demand transparency.

Ready to See It for Yourself?

The best way to understand how IQLs work is to try them yourself. In just a few clicks, you can start finding in-market buyers and turning intent signals into pipeline.